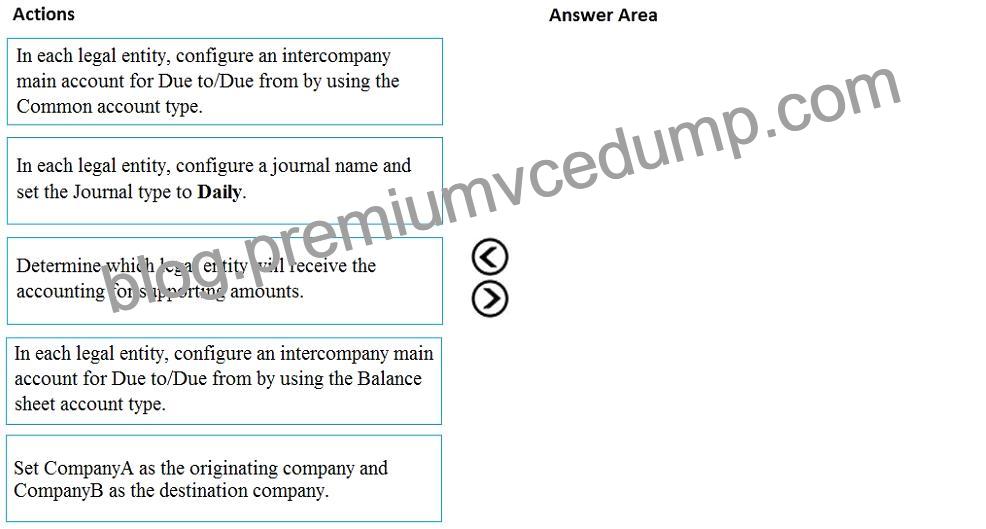

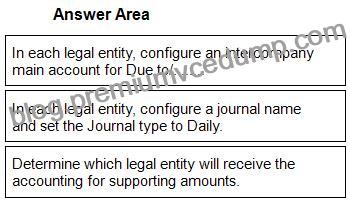

NEW QUESTION 39

You are configuring a Dynamics 365 Finance environment for intercompany accounting. You create the following legal entities:

CompanyA

CompanyB

You need to configure intercompany accounting for both legal entities.

Which three actions should you perform in sequence? To answer, move the appropriate actions from the list of actions to the answer area and arrange them in the correct order.

NOTE: More than one order of answer choices is correct. You will receive credit for any of the correct orders you select.

1 – In each legal entity, configure an intercompany main account for Due to/……..

2 – In each legal entity, configure a journal name and set the Journal type to Daily.

3 – Determine which legal entity will receive the accounting for supporting amounts.

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/intercompany-accounting-setup

NEW QUESTION 44

You are a functional consultant for Contoso Entertainment System USA (USMF).

USMF plans to implement a new manufacturing department that will be based in Australia.

You need to create a draft account structure for the new department. The account structure must use the same account structure as a department named Manufacturing India and be named Manufacturing Australia.

To complete this task, sign in to the Dynamics 365 portal.

See explanation below.

Explanation

You need to create an account structure with the same structure as the department named Manufacturing India by using the following instructions.

* Go to Navigation pane > Modules > General ledger > Chart of accounts > Structures > Configure account structures.

* On the Action pane, click New to open the drop dialog.

* In the Account structure field, type a name to describe the purpose of the account structure.

* In the Description field, type a description to specify the purpose of the account structure.

* Click Create.

* In the Segments and allowed values, click Add segment.

* In the dimensions list, select the dimension to add to the account structure.

* At the end of the list, click Add segment.

* Repeat step 6 to 9 as needed.

* In the Allowed value details section, select the segment to edit the allowed values. For example, click the Main Account field.

* In the Operator field, select an option, such as is between and includes.

* In the Value field, type a value. For example, 600000.

* In the through field, type a value. For example, 699999.

* In the Allowed value details

* Repeat step 10 to 15 as needed.

* In the Allowed value details

* In the Operator field, select an option, such as is between and includes.

* In the Value field, type a value. For example, 033.

* In the through field, type a value. For example, 034.

* Click Apply.

* In the grid, select the segment to edit the allowed values. For example, Cost Center.

* In the CostCenter field, type a value. For example, 007..021.

* In the Segments and allowed values, click Add.

* In the MainAccount field, type a value. For example, 600000..699999

* In the grid, select the segment to edit the allowed values. For example, Department.

* In the Department field, type a value. For example, 032.

* In the CostCenter field, type a value. For example, 086.

* On the Action pane, click Validate.

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/tasks/create-account-structures

NEW QUESTION 45

You need to identify the root cause for the error that User5 is experiencing.

What should you check?

Topic 1, Munson’s Pickles and Preserves Farm

This is a case study. Case studies are not timed separately. You can use as much exam time as you would like to complete each case. However, there may be additional case studies and sections on this exam. You must manage your time to ensure that you are able to complete all questions included on this exam in the time provided.

To answer the questions included in a case study, you will need to reference information that is provided in the case study. Case studies might contain exhibits and other resources that provide more information about the scenario that is described in the case study. Each question is independent of the other questions in this case study.

At the end of this case study, a review screen will appear. This screen allows you to review your answers and to make changes before you move to the next section of the exam. After you begin a new section, you cannot return to this section.

To start the case study

To display the first question in this case study, click the button. Use the buttons in the left pane to explore the content of the case study before you answer the questions. Clicking these buttons displays information such as business requirements, existing environment, and problem statements. If the case study has an All Information tab, note that the information displayed is identical to the information displayed on the subsequent tabs. When you are ready to answer a question, click the button to return to the question.

Background

Munson’s Pickles and Preserves Farm grows and distributes produce, jellies, and jams. The company’s corporate headquarters is located in Dallas, TX. Munson’s has one operations center and seven regional distribution centers in the United States.

The company has two wholly owned subsidiaries that operate in Canada. The Canadian entity owns an entity in France.

Munson’s plans to expand into Latin America by purchasing the last 25 percent of a subsidiary that they own in Costa Rica. This process is expected to complete within the next two years.

The company plans to implement Dynamics 365 Finance and Dynamics 365 Supply Chain to meet their growing business needs.

Current environment. General

Munson’s uses a mix of internally-developed legacy systems that handle their finance and distribution activities. The company has an isolated CRM system.

* Both Canadian subsidiaries have two departments: marketing and operations.

* Financial reporting is difficult due to data residing in disparate systems.

* Financial reporting is currently performed by using Microsoft Excel.

* Pre-orders in the current system are difficult to track because the order management system is not integrated with the finance system.

* Pickle sales post to one revenue account, but this does not allow for targeted reporting by pickle cut and type.

Current environment. Organization

The following chart shows Accounting/Reporting Currencies and Tax ID, if applicable.

* Typically, vendor invoices are received prior to receipt of product.

* The following fixed assets are sold for a loss:

* BUILD-100

* CAR-1233

* At the regional distribution centers, the value for physical inventory does not match the inventory in the financial system.

* Munson’s rents their corporate office. Rent is not paid by purchase order. Rent is due once a quarter.

* Allocations are performed manually.

* Barrels are inventoried by site and warehouse.

* Munson’s has multiple depreciation and tax books for all of their fixed asset equipment.

* Budgets are posted at the department level for each legal entity.

Requirements. Sales

* Customers should be able to pre-order for fall release of pickles.

* Three-way matching must be enforced for all purchases.

* Fixed asset sale transactions require a ledger account entered at the time of transaction.

* Fixed assets purchased must be automatically created in fixed asset module. This includes inventory items and write in purchase orders/non-inventoried items.

* One dollar from every sale needs must be tracked and donated at the end of each month to a charitable organization.

* Purchasing budgets must be enforced at the main account level.

Requirements. Finance

* Accounts payable must be able to enter vendor invoices on the day they were received to be settled against when product is received.

* Accounts payable must be able to enter vendor invoices to accrue expense without specifying a purchase order at the time of entry.

* Postage expenses must be split evenly across the regional distribution centers automatically.

* Administrative expenses must be distributed across the regional distribution centers by percentage of fulfillment orders monthly.

* Pickling machines depreciation must be uniquely recorded for visibility but not post to the ledger.

Issues

* During implementation testing, User1 indicates that after packing slips are generated for purchase orders, there are no ledger postings.

* User2 indicates that fixed assets purchased on a purchase order do not show up in the Fixed Assets module.

* User3 reports that they are seeing inconsistent application of the one-dollar donation from all sales orders.

* User4 in the Canadian subsidiary is able to purchase supplies for marketing despite exceeding the marketing department budget.

* User5 reports that when purchasing a non-inventoried computer, the system is automatically assigning it to the buildings fixed asset group.